south carolina inheritance tax 2021

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away.

Real Estate Property Tax Data Charleston County Economic Development

June 2021 5 Tax Year 2020 Single.

. Only six states actually impose this tax. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. The lawyers at King Law can help you plan for what happens after youre gone and were here to help you get a better sense of where you stand.

South Carolinas zero tax bracket and overall tax structure contribute to the states smaller effective tax burden. The rate threshold is the point which the marginal. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets.

South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. No estate tax or inheritance tax No estate tax or inheritance tax.

The requirements for a valid will change from state to state but are pretty straightforward in South Carolina. We invite you to come in and talk with one of our attorneys in-person during a consultation. November 2019 3 october 2019 2 september 2019 3 august 2019 4 july 2019 2 Iowa has an inheritance tax but in 2021 the.

South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. This increases to 3 million in 2020 Mississippi. 117 million increasing to 1206 million for deaths that occur in 2022.

No estate tax or inheritance tax. However the state does have its own inheritance laws that govern which beneficiaries will receive portions of an estate after a loved one dies. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The top estate tax rate is 16 percent exemption threshold. In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating. An additional four states implemented income tax cuts in 2021 that were previously adopted or were automatically triggered upon meeting revenue.

In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. For 2021 the nonrefundable credit is equal to 8333 of the. South Carolina Retirement - Taxes And Economic Factors To Consider.

It has a progressive scale of up to 40. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

The inheritance tax ranges from 5 to 15 depending on the amount of the inheritance and the relationship of. A married couple is exempt from paying estate taxes if they do not have children. Your federal taxable income is the starting point in determining your state income tax liability.

Tax brackets are adjusted annually for. It is important that everyone understands the states intestate. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

Individual income tax rates range from 0 to a top rate of 7 on taxable income. As in north carolina south carolina does not tax social security benefits. Writer must be of sound mind and body.

However according to some inheritance laws of South Carolina not all the deceased persons property may be considered as a part of the estate. South Carolina income tax rates range from 0 to 7. The median property tax in South Carolina is 68900 per year for a home worth the median value of 13750000.

The top estate tax rate is 16 percent exemption threshold. No estate tax or inheritance tax. Will must be signed by the writer and two.

As of 2019 iowa kentucky maryland nebraska new jersey and pennsylvania have their own inheritance tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. No estate tax or inheritance tax.

Writer must be at least 18 years. If they are married the spouse may be able to leave everything to each other without paying any estate tax. Learn about the state tax rates for income property sales tax and more to estimate your 2021 tax bill.

Federal exemption for deaths on or after January 1 2023. 4 The federal government does not impose an inheritance tax. In addition gifts to spouses who are not US.

Federal Adjusted Gross Income. New for Tax Year 2021 Filing Tips Get organized before you file. The District of Columbia moved in the.

Creating a will is oftentimes the first step that South Carolina residents must take in estate planning. No estate tax or inheritance tax. South carolinians pay an average 601.

South Carolina has no estate tax for decedents dying on or after January 1 2005. South carolina inheritance tax and gift tax. That way a joint bank account will automatically pass.

A federal estate tax is in effect as of 2021 but the exemption is significant. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. No estate tax or inheritance tax.

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. Our number is 888-748-KING 5464.

South Carolina Retirement Taxes And Economic Factors To Consider

South Carolina State 2022 Taxes Forbes Advisor

A Guide To South Carolina Inheritance Laws

The True Cost Of Living In South Carolina

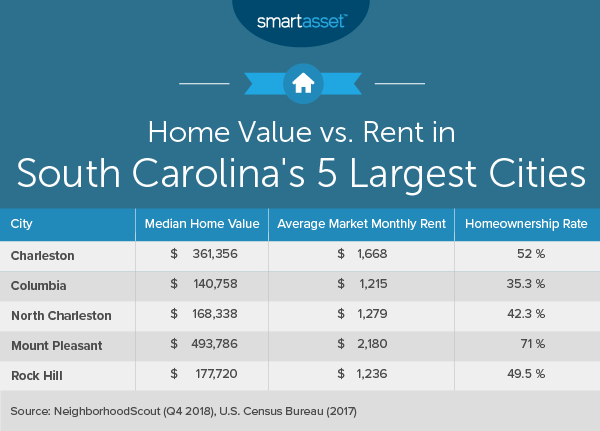

Cost Of Living In South Carolina Smartasset

South Carolina Sales Tax Small Business Guide Truic

Where S My Refund South Carolina H R Block

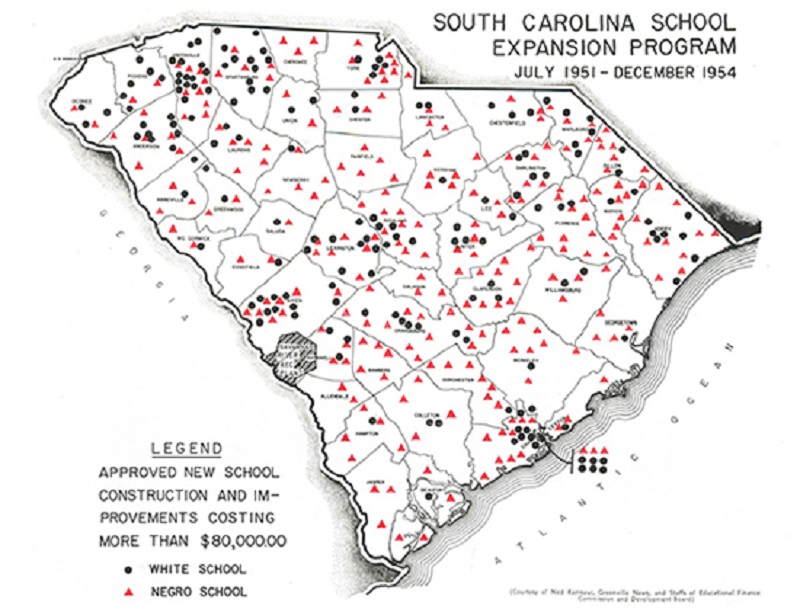

Separate But Equal South Carolina S Fight Over School Segregation Teaching With Historic Places U S National Park Service

South Carolina Property Tax Calculator Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Landlord Tenant Laws Update 2020 Payrent

A Guide To South Carolina Inheritance Laws

South Carolina Estate Tax Everything You Need To Know Smartasset

Ultimate Guide To Understanding South Carolina Property Taxes